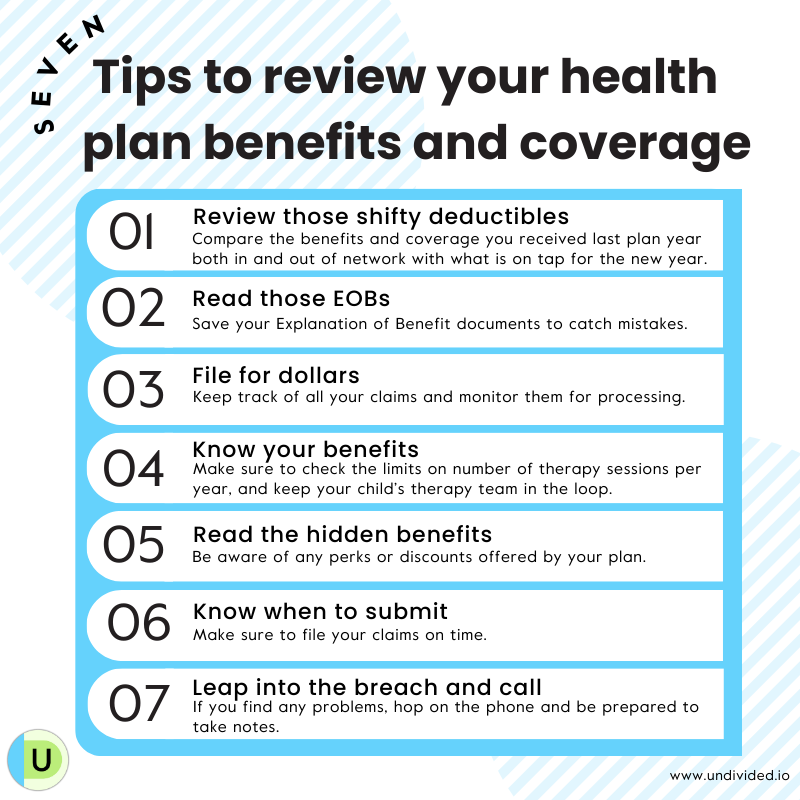

How to Review Your Health Plan Benefits & Coverage

Many health plans turn over with the end of each calendar year, while others follow a schedule determined by an employer. Whenever your new plan year begins, it’s a valuable opportunity (and yes, a small headache) to review your benefits and make sure you understand what, if anything, has changed so you can get the most out of your plan benefits. From reviewing your deductibles to renewing your zeal for filing out-of-network claims, we’ll walk you through the process here.

And remember: you’ll need to share a copy of your new plan’s ID card with your child’s providers! (You can download the card from your plan’s website.) It’s much more convenient to do this from the comfort of your computer than it will be when you are standing at the reception desk or — worse — after a claim has been submitted and rejected by what is now the “old plan.”

Review those shifty deductibles

Has the deductible increased? What about your share of cost? Compare the benefits and coverage you received last plan year both in and out of network with what is on tap for the new year. Access the summary of benefits for the new year and ask yourself:

Is pre-authorization required for such services as acupuncture and chiropractic care, and the big four for our kids: OT, PT, speech, and ABA?

Has your share of cost seen an uptick? For example, is your 20% liability now suddenly at 40%?

Don’t overlook plan details that cover the dentist and trips to the pharmacy. Make sure you know what you’re opting into and out of for filling teeth and prescriptions.

Read those EOBs

The EOB, or explanation of benefits, is the claim document generated when bills for services are filed by you or by your child’s provider. Start thinking of the EOB as a roadmap to the financial story of every medical encounter you have AND the mechanism by which to confirm or pursue correct payments.

EOBs are too often — and see if you recognize your pattern here — tossed in the junk drawer, used as coasters for coffee cups and wine glasses, or put into neatly labeled file folders and left to gather dust. But EOBs contain information you need to be on equal footing with your health plan, so don’t toss these envelopes aside! If you have filed correctly and your out-of-network deductible isn’t astronomical, some of the envelopes you receive may contain payment. But every envelope contains valuable information.

Don’t trust the health plan to get it right. If you are reading your EOBs you can sometimes catch the plan red-handed. They do indeed make mistakes.

File for dollars

There can be multiple ways to file claims. Regardless of how you file, retain a copy of everything you submit at least until processing is complete.

If you’re someone who likes to have a paper trail, you can still file your claims by mail. Look online at the health plan website for a blank claim form. Save time by creating a master claim form with all the basic unchanging demographics entered.

Check to see if faxing your paper claim is an option. Filing by fax saves mailing time and postage — and it creates a handy record. If you’re able to fax, always remember to save a transmission receipt with the correct date stamp.

Many people prefer to file using their health plan’s website message center, online chat, or by email, and this option is becoming available for more and more health plans. In addition to saving mailing time and postage, you will get a response message acknowledging receipt of the claim you’ve filed. If you’re using the chat feature, you have the additional benefit of being able to refer back to the saved record of these conversations with your plan’s customer service representatives.

Finally, it’s a good idea to use the member website to monitor your claims processing. You can confirm that processing has begun and also see processed claims sooner, thus catching any potential problems sooner.

Know your benefits

Many health plans put an annual limit on the number of occupational, physical, and speech therapy sessions they will cover depending on diagnosis. Some plans authorize 24 per year, and some provide 30 or 50. If your child has more than one of these services, find out if the per-year limit is combined between services, or if there is a separate accumulator per service: for example, 30 for OT, 30 for PT, and 30 for speech. If you can, call for pre-authorization early, and keep your child’s therapy team in the loop on any documentation that’s required.

Use this worksheet created by Undivided's Director of Health Plan Advocacy Services, Leslie Lobel, to audit your plan and better understand your benefits and coverage limits.

Know when to submit

Leap into the breach and call

Have you discovered a problem with your submitted claim? No big surprise there! Now it’s time to communicate with the plan.

So let’s prepare for those customer service calls.

If you can, avoid calling on Mondays, as this is generally the busiest day of the week and lunch time the busiest hour of any day. Try the earliest or latest hours, or weekend times if available.

Be ready to take notes. Have pen and paper, device, or laptop handy and all the info you need from your EOB.

Always note the date of your call and get a name and a call reference number. Every call generates a reference, but you have to know to ask for it. Check the plan website to see if live chat or a customer service message center are options on your plan.

Holding your health plan accountable for accurate reimbursement is good for your financial health and (despite short-term frustration) can in the long run reduce stress and anxiety and impart a sense of control. You may not always like what the plan is paying, but you need to understand how they are paying. Let’s make this the year that you stop being part of the percentages that the plans count on to just give up and go away!

Review insurance coverage

Join for free

Save your favorite resources and access a custom Roadmap.

Get StartedAuthor