Budgeting Basics to Keep Your Family Afloat

Undivided is excited to feature Brianna Davidson Jarrett as an author in our financial planning series! For more, check out our Future and Financial Planning Decoder.

I became a partner in a large law firm when my twins were still drinking bottles of pumped milk, and my oldest kid was just starting to learn numbers and letters and how to not wet the bed. I had an infant on oxygen, wearing a pulse ox and a Ponseti brace, and I had a raging caffeine addiction. I was brand-new to the world of durable medical equipment and just beginning to come to the realization that my health insurance company existed for the purpose of rejecting the claims that were pouring in and paying the least amount they could get away with under the terms of the policy.

Those were the days when I pumped milk in the middle of the night, woke up pumping, handed the twins’ care off to my husband, helped with as much as I could before I left for the office, pumped in the car on the way to work, pumped in the car on the way home, made dinner, held babies, wiped butts, and collapsed for an hour of sleep before doing the whole thing again in the morning. There were many days my husband didn’t even make it downstairs because as soon as he was done with one care routine, another began. Once I came home from work to find him and the twins in our room, everyone still in their pajamas from the night before. He had tied a few baby toys to the blades of our ceiling fan with some string. “I made a mobile,” he explained unashamedly.

Life was a chaotic, disorganized, and overwhelming mess. We didn’t open our mail. Every single day, the mailbox was stuffed full of Explanations of Benefits, doctors’ bills, and then collectors’ notices. We spent hours upon wasted hours trying to make heads or tails out of the bills, all to no avail. I received a notice from the health insurance company asking whether my son had been in some sort of accident and maybe someone else should be held responsible for his medical bills — sorry, no, he was just randomly born with lots of medical needs, thanks for asking!

And then we hit our lowest point. One day I went out to the driveway to get in my car, only to discover my car wasn’t there. Apparently that’s what happens if you forget to pay your car payment.

That was our wake-up call. As difficult and as crazy as life was, we had to get our you-know-what together, open the mail, and figure out a system to make sure stuff got paid. On time.

Here are some habits we started back then (which we’ve continued through fluctuating income, types of health insurance, job changes, and monthly/annual costs) that have served us well.

Establish the discipline of monthly budgeting for short-term financial goals

Every month, I open my budgeting journal and draft a budget for the month. I start with all the income I know is going to come in, and I list all of the expenses I know I will have. And then I do this thing where I dump whatever is left over into little buckets that I will use later on in the year.

This exercise is annoying. I hate doing it. Sometimes, it makes me panic a little.

But it’s the only way I know how to plan ahead for things like the kids’ birthdays, holidays, vacation, school supplies and clothes, etc. etc. etc. It’s a habit I started long ago and have kept up faithfully because it works. I know there are very clever and user-friendly apps that exist to help with this; I know you can do it electronically, or keep it in your phone, but I remain a pen and paper gal — it’s what works for me. Do what works for you. This is the exercise that communicates to me how much I can spend at the grocery store every week. How many times I can fill up my gas tank. How many extracurricular activities we can participate in this month. Once I plan the budget, I walk into each scenario knowing in advance how much I can spend and still meet my financial goals.

And for this to work, you need to know your short-term financial goals.

We celebrate Christmas, and I like to go big at Christmas. It’s pretty tough for our family to travel because transporting oxygen is more difficult than amending an IEP (if you know, you know), so we go all-out for the holidays around here. For example, the year my son had two major surgeries, we spent a lot of our time in the PICU. That was the Christmas my daughter got the Barbie Dreamhouse, and I could have cared less what the price tag read. But here’s the thing: I know in January what I want to spend on Christmas in December, and I plan in advance how I’m going to do it. Now that I have a few years under my belt, I know roughly how much I need to save for the holidays, and every month I set aside some money in the monthly budget to make sure I have enough by December.

I host Thanksgiving. Next to planning and lawyering, cooking is my favorite activity, and Thanksgiving is my Olympics. I’ve gotten in the habit of saving my credit card rewards all year and cashing them out in November to pay for all the groceries I like to buy for Thanksgiving. Because I don’t want to be in Sprouts or Trader Joe’s or Whole Foods about to cry because the price per pound on fresh green beans is unconscionable or dairy is way too expensive due to supply chain issues. I want to make all the things and not worry about it.

That being said, you would not believe how little I spend on food and groceries every month. This is an area I have trimmed RUTHLESSLY. I can tell you from experience that cooking is cheaper than eating out. I happen to love cooking. I do it every single day. I actually really enjoy the challenge of making something out of almost nothing. The food I buy is high quality, but I plan how I’m going to use it, how long it will last, and I only buy what I need. I go to the grocery store once a week, four times a month, and no more. Cooking might not be your thing, but at least knowing how much you’re spending on food and planning in advance how much you’ll spend will help you meet your short-term financial goals.

Budgeting: the Nitty Gritty

I know that the nitty gritty exercise is an absolute mood kill. But please hear me when I tell you it is no better or worse than the difficulties you are already handling on a daily basis.

This is how simple your monthly budget can be, and this is the skill most apps are offering to do for you: think through your income and expenses for the month.

Tip: If your income fluctuates because you work on commission or you are a small business owner, ESTIMATE. Base your estimate on the average you’ve brought in over the last few months.

Some expenses are the same and you can count on them being the same from month to month (mortgage, rent, health insurance premiums, tuition, therapies, Wi-Fi, etc.). List them. Here is an example:

INCOME:

$8,000

EXPENSES:

$3,000 mortgage

$1,500 tuition

$600 health insurance

$250 therapies

$2,650 LEFT

After you list the expenses you know you will have month-to-month, start listing the expenses you need to estimate:

$800 groceries: 4 weeks of groceries @ $200/week

$200 gas

$150 movies (I want to take the kids to the movies a couple times this month, as it is one of the few activities my child with disabilities can enjoy with his siblings)

$150 kid’s birthday

$1,350 LEFT

And out of this $1,350, I will squirrel some away for Christmas, vacation, new school clothes, or date night.

If you know that you want to spend between $4,000–$5,000 at the end of the year on the holidays, that means you need to be ready to save about $400–$500/month starting in January, so that by November the money is there to spend.

A tip: if you are married or cohabitating with someone and you have combined your finances, get in the habit of having a monthly (or bi-weekly) “business meeting” during which you both know what the expenses and monthly budgeting goals are — this should cut down on any budgeting surprises (Hey, I see you went to Starbucks literally every day this week…), and help both of you stay accountable.

Another tip: if you are paid biweekly, you may have one or two months in the year in which you receive an extra paycheck. That’s an easy way to plan to set money aside for bigger expenditures (like durable medical equipment that’s not covered by insurance, or vacation).

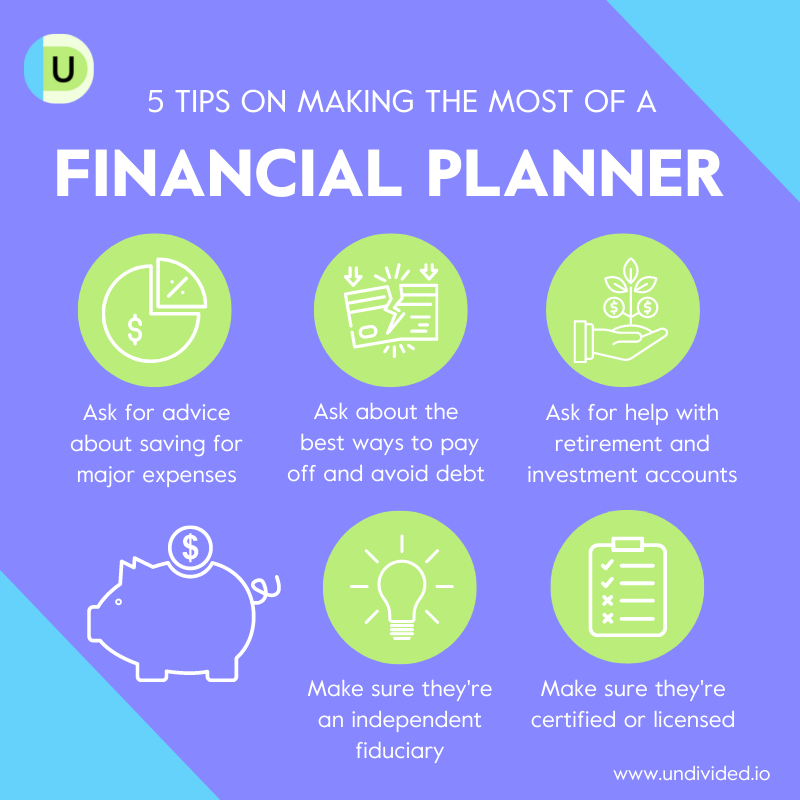

Get a financial planner for long-term financial goals

I’ve talked to people who are very much opposed to the idea of having a financial planner because they believe they can handle this on their own — with Google. As with most things that most of us have too little experience in, you should get someone on your side who knows what they’re doing: meaning they have a degree or a license.

My husband and I consulted with a financial planner who helped us get retirement plan accounts started; we began auto-deducting funds from our checking accounts to contribute to those accounts. When we started to build a balance of real money in those retirement accounts, we split our focus between saving for retirement and contributing to college savings accounts for the kids.

The advantage of having a certified financial planner is that you have access to an educated professional who is familiar with your long-term goals and can give you advice about how much you should be saving in order to meet those goals. You want someone who knows what they’re doing, especially when you have these types of questions:

- I’m thinking about taking a job with a lower annual salary but better benefits. Will the savings in health insurance costs offset the lower income? Can we set up a time to talk this over?

- We’re selling our house and will have a chunk of money to set aside. What’s the best way to invest that?

- I saw something about the stock market crashing in the news, and now I’m terrified. Please hold my hand — what do I do?

Our financial planner has also been the person we’ve leaned on to talk through the medical expenses we face, and who has helped us plan how to pay for them — for example, by holding onto tax refunds, bonuses from work, etc. — in liquid investments that can be accessed quickly and earn a relatively high rate of interest.

I’m a big fan of financial planners who are independent fiduciaries. What does this mean? It means that my financial planner is not going to sell me something weird that I don’t understand and that I don’t need because the company they work for does not put them under a quota to move a certain number of annuities/life insurance policies. When I call and say, “Hey Financial Guy, I’m rolling my 401K over from my previous employer — what’s the best thing to do with it?” it means that I can trust 100% that the advice he’s going to give me is what’s best for my family, even if he makes $0.00 of commission on that rollover.

Make sure you also engage a person who is intimately acquainted with your income, your expenses, and the big-ticket items you’re going to need cash to pay for in the near- and long-term future. They should be calling you to say:

- “Hey, you said you were going to need to pay for a wheelchair ramp this month. Were you able to do it? Do we need to pull some money from your brokerage account?” (This would of course only apply to those of us unlucky enough to live outside California. Imagine having state-run agencies that care about supporting your kid’s right to a meaningful life!)

- “How’s the new job going?”

- “What is the amount of your health insurance deductible this year?”

How to find a financial planner:

- Ask your estate planner. Generally, estate planners already have financial planners that they work with or have referred clients to over the years, and most estate planners are only going to recommend other professionals that they know and trust.

- Ask friends and family. Find a planner who already has a good working relationship with someone you know and trust.

- Look for an independent financial planner who is a full fiduciary. And you should ask, “Are you an independent financial planner and are you a full fiduciary? Where is that indicated on your website?”

Why use an independent financial planner who is a full fiduciary?

An independent financial planner who is a full fiduciary is not the same as a financial planner for a large company that has to sell a certain number of financial products every quarter in order to earn a promotion. Why does this matter? If your financial planner has to sell X number of long-term disability insurance policies, their advice to you and your family is going to be heavily influenced by that. An independent fiduciary has no obligation to sell these products to you and can give more objective advice.

A financial planner at an independent firm who is a full fiduciary is not making a commission off of the products that are sold to you. Instead, that person is going to receive a fee from the accounts that they are managing for you, and you should be able to see the fee deducted right on the account statement. A financial planner who is not a full fiduciary may try to tout the fact that there is no fee coming out of your account, but rest assured they’re still being paid because they’re making a commission off of your investments and you won’t be able to see what it is. I’m a big fan of the transparency of a full fiduciary.

In conclusion

What I hope you take away from this article is not that there is any one particular way to do this, but that (1) you can develop a method that works FOR YOU, (2) it is a practice and a discipline, and (3) most of this is literally just thinking ahead, and there is no magic to it whatsoever. These are just a few examples of the planning that I’ve done to avoid those surprises that can throw off the financial plan. Think about things like family birthdays, Fathers’/Mothers’ Day, holidays, vacation, THE HEALTH INSURANCE DEDUCTIBLE THAT YOU’RE DEFINITELY GOING TO MEET. Planning ahead can give you the tools you need to meet these goals.

Join for free

Save your favorite resources and access a custom Roadmap.

Get StartedAuthor