Making the Most of Medi-Cal

Medi-Cal can be an invaluable source of health care coverage for children with disabilities. However, it can be difficult to navigate the enrollment process, especially if your child already has private insurance coverage. Our Public Benefits Specialist, Lisa Concoff Kronbeck, talked with us about how best to use Medi-Cal as secondary coverage and to pay for expenses that aren’t covered by private insurance, such as durable medical equipment (DME) or consumable medical supplies.

California offers several programs that allow people with disabilities to qualify for Medi-Cal regardless of their household income. Children with developmental disabilities who are Regional Center clients may qualify through the Home and Community-Based Services for the Developmentally Disabled (HCBS-DD) Waiver.

What are the benefits of Medi-Cal eligibility?

Medi-Cal does much more than pay for health care costs. It can also qualify your child for certain government benefits that they could not access otherwise. For example, an individual must be enrolled in Medi-Cal to receive In-Home Supportive Services (IHSS). Vision and dental care are also covered under Medi-Cal.

Medi-Cal also helps to pay for a number of services, including:

- Respite

- Tailored day services

- Transportation

- Skilled nursing

- Behavioral supports

- Housing and vehicle modifications

- Day programs

- Social skills therapy

- Neuropsychology services

You can find much more information about these services in our Medi-Cal Terms and Services Glossary.

✅ Did you know you may be able to get discounts on your utility bills if you use in-home medical equipment? Check out our article for information about the Medical Baseline Allowance program and other utility discounts available to Medi-Cal recipients.

What is coordination of benefits (COB)?

Coordination of benefits (COB) refers to the method that insurance plans use to provide coverage and determine payment responsibilities for someone who is covered by more than one health plan. Concoff Kronbeck explains that Medi-Cal is the payer of last resort, which means that all other health plans you may be enrolled in — such as private insurance, a group health plan, or a managed care organization — are legally required to pay for their part of any claims before Medi-Cal will pay anything.

To ensure that insurance companies and other third parties pay their share, the state collects information on any pre-existing coverage whenever someone applies for medical assistance. If a family applies for Medi-Cal for their child, they must also show proof of any insurance or other third party coverage.

County-managed Medi-Cal plans

Children without a private primary insurer must enroll in a Medi-Cal managed care plan such as HealthNet or LA Care and its contracted programs, including Anthem Blue Cross and Blue Shield of California Promise Health Plan. Kaiser may be available on a limited basis, generally only to current and recent Kaiser patients (with Kaiser coverage in the past 12 months), as well as patients who have a family member with Kaiser, current and former foster youth, and individuals with both Medicare and Medi-Cal.

Available plans vary depending on your county. If you do not select a plan, you will be assigned one.

Managed care plans can also be used as secondary insurance if families enroll in the same Medi-Cal HMO as their primary insurance (if it is available in their county). In these cases, Medi-Cal typically covers what the primary insurance doesn’t.

There are some great online resources to help you choose the right managed care plan as your child’s sole insurance coverage. You can use the California Department of Health Care Services (DHCS) to:

- Compare up to three health care or dental plans.

- Find information on standard benefits, pharmacies, urgent care centers, and more.

- Search for a specific provider or hospital to see if they accept a Medi-Cal managed care plan.

- Get contact information for each provider.

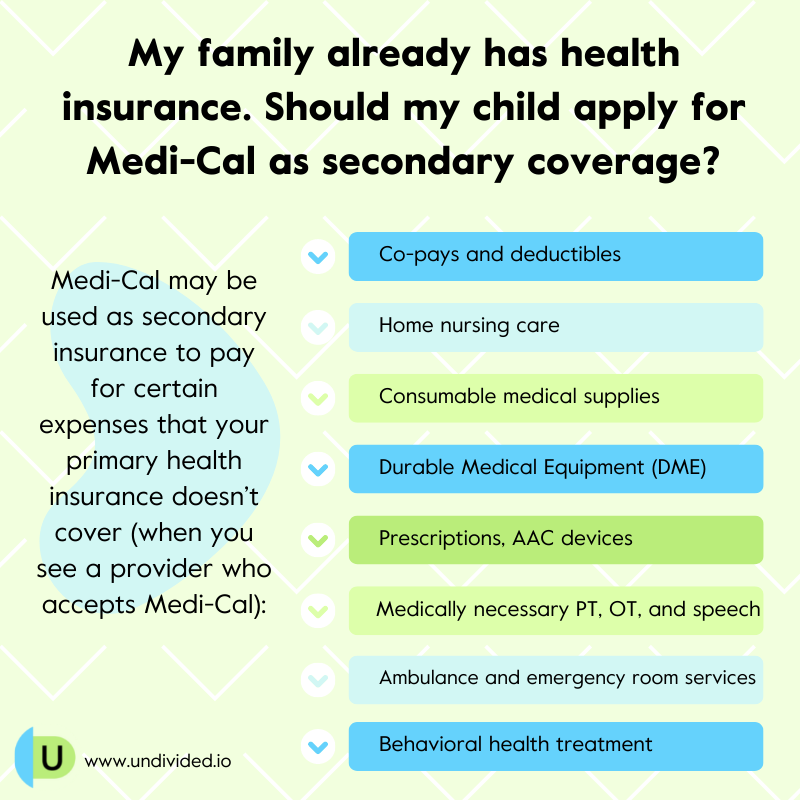

Medi-Cal as secondary insurance

Families who already have health insurance coverage for their child can still benefit from Medi-Cal, as it may be used as a secondary insurance to pay for certain expenses that your primary health insurance doesn’t cover.

Check out our article about using Medi-Cal as secondary insurance to learn more about how to enroll, how to get medically necessary supplies and services covered, and how to handle treatment authorization requests (TAR).

What to do when Medi-Cal denies a claim

If Medi-Cal denies coverage for something your child needs, you are entitled to an appeal. An appeal is used when your care plan has taken an Adverse Benefit Determination (ABD), or an action “that affects your care, such as delay, modification, denial, or reduction of services, denial or only partial payment for a service, or the determination that the requested service was not a covered benefit.”

The appeal process changes depending on whether you are enrolled in a managed care plan or straight Medi-Cal:

Those with straight Medi-Cal can contact their county office to file a formal complaint and request a Medi-Cal Fair Hearing.

If you’re on a managed care plan, contact your plan’s customer service number. If this does not resolve the problem, you can file an appeal with your care plan. For assistance with this process, you can contact the Medi-Cal Managed Care and Mental Health Office of the Ombudsman.

If a managed care plan does not contract with any providers for a service that is medically necessary and is otherwise covered by Medi-Cal, recipients may request a TAR via fee-for-service Medi-Cal. For example, if your doctor has ordered home LVN care for your child but your managed care plan does not contract with any home health agencies, the service may be accessed through fee-for-service Medi-Cal instead. The managed care plan remains the starting point for initiating this process as they will need to provide documentation that they don't contract for the service.

For more information, see our full article The Medi-Cal Appeal Process.

Join for free

Save your favorite resources and access a custom Roadmap.

Get StartedAuthor