Special Needs Trusts: The Basics

Undivided is excited to feature Brianna Davidson Jarrett as author of our financial planning series! For more, check out our Future and Financial Planning Decoder.

Setting up a special needs trust is planning for the thing that you know is gonna happen but that you don’t want to ever think about happening.

No one but you has any clue how stressful it is to manage a family when you have a child with disabilities. As the parent of a child with disabilities, I know that an outside observer or even other family and friends cannot possibly have any idea what I deal with on a daily basis. Where do I even begin? Doctors’ appointments, therapy, medication, health insurance, SCHOOL, any activity that requires leaving the house for any period of time, curiosity from other people, getting the child out of bed and dressed in the morning, getting the child bathed and back into bed at night — just the volume of things that require careful planning and management (that for other people are often routine or mundane) can be absolutely staggering. Add to this thinking through what would happen if you weren’t around? No, thank you. Nice no to that.

If you have heard anything about special needs trusts, I’m going to guess that what you’ve heard has been convoluted and unhelpful. In this article, you’ll be getting the working-mom-of-a-kid-who-uses-a-wheelchair version of this information. Sit down and hold onto something.

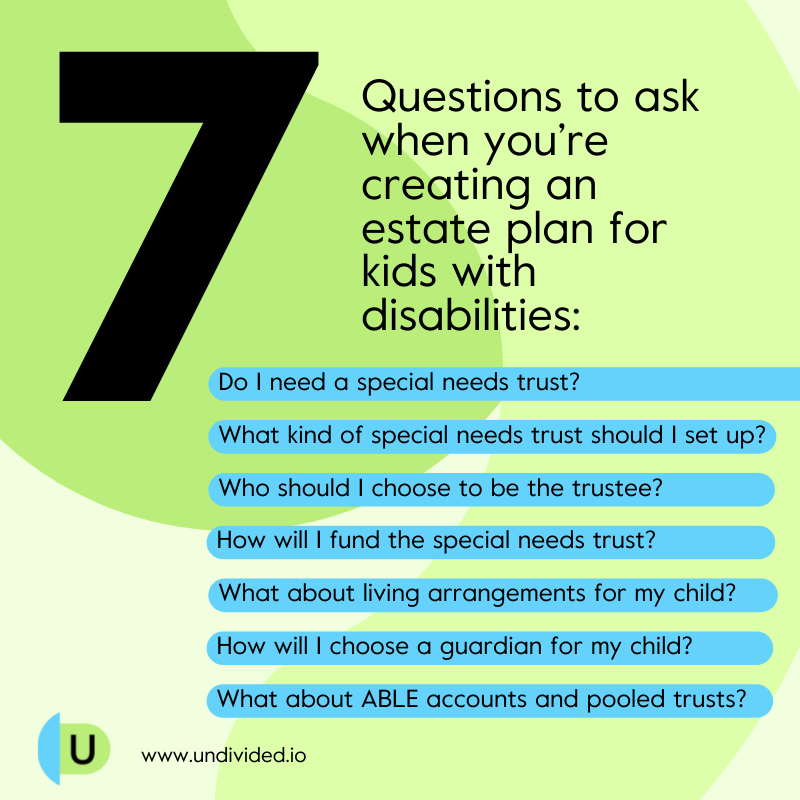

Do you need a special needs trust?

I remember my first experience interviewing a nanny when I had one typical child and, bless my heart, I thought mothering was so hard. The nanny candidate explained that she was very skilled in teaching sign language to infants. All I could think was, “What the hell. Is that something I need to do???”

Reader, getting a special needs trust is not the same level of importance as sign language for your typical infant. It is a critical part of your estate plan because it allows you to leave an inheritance to a child with disabilities without interfering with their financial government benefits.

You might say to yourself, “I don’t care about this because my kid is not receiving any government assistance.” You might also say, “I don’t care about this because the benefits program my kid is involved in has no financial test for them to qualify.” And my response to you would be: you don’t know what the future could bring for your child.

At the time you pass away, your child might very well need to qualify financially for a benefits program. What if the government program from which they have been receiving benefits changes? What if your child’s condition worsens over time, and they need benefits that they did not need previously? These are the reasons why it is critical to include a special needs trust as part of your estate plan when you have a child with disabilities.

You probably know that qualifying for public benefits programs can be excruciating. The non-fillable forms. The signatures. The doctors’ signatures. The home visits. When I received my son’s Medicaid application, I’m not kidding you — I CRIED. It’s just not fair, am I right? We are already doing so much! You can spend hours upon tedious hours filling in the forms, you finally get everything done and send it, and...it gets lost. No one ever received it. “Ma’am did you keep a complete copy?” SURE, THAT’S WHY I’M SO UPSET. All that is to say to you: if there is any possibility my child will be qualifying financially for benefits while I’m alive or after I’m dead, I would move heaven and earth before they lose those benefits. They are HARD to get and EASY to lose.

What kind of special needs trust should you set up?

A trust is simply a tool used in estate planning to control the inheritance that you leave after you pass away. Instead of giving a portion of your estate to a person, outright, you place it in the hands of someone else you’ve appointed (the “trustee”) to manage according to the terms of the trust.

As if this wasn’t fun already, there is more than one type of special needs trust. You should meet with an estate attorney who is experienced in drafting special needs trusts and ask that person what type of special needs trust is the most appropriate for you and your family. Here’s a bit about why:

In a trust, the concept is to put assets into the hands of a trustee to use for the benefit of your child. The trust will spell out how the trustee is permitted or required to use those assets. The important language usually included in these trusts is that the funds in the trust are there to supplement and not to replace any government benefits the child may be receiving.

Some special needs trusts are effective while you are living, and some are only effective after you pass away. It is also possible to include some combination of both. You should be sure that you understand what is being recommended to you and why.

✅ Tip: what is a letter of intent and do you need one? As attorney Debra Koven tells us, “A letter of intent is a companion document for your SNT. While not legally binding, it will provide both your guardian and your trustee invaluable information and guidance to care for your special needs adult/child. The whole point of creating an estate plan is to give you peace of mind that you've made the decisions you believe to be best for your family after you pass away. To that end, a letter of intent is an additional way to protect and care for your special needs adult/child. The letter should contain important information about the people and places in your child's life; details regarding the services they require and receive; instructions on their daily activities; and any additional information the parents know helps their special needs adult/child all in hopes of making the transition from one caregiver to another, as seamless as possible for the special needs adult/child."

Who should you choose to be the trustee?

You should ask your estate planner whether they recommend a corporate trustee or whether you should select someone you know (and why). The person serving in the role of trustee will have a lot of work, a lot of responsibility, and a lot of discretion.

The trustee must be able to say no to the child sometimes. “Aunt Amanda, I need some of the money from my trust account to buy a car for my new boyfriend who I met online. No, we have never met in person. Yes, he’s real. Because I know. I was thinking a Ferrari.” No. A thousand times no.

The person you choose should be able and willing to stay on top of things that need to be paid on a regular basis. This trust might be paying for health insurance premiums, or horseback riding lessons, or tuition. None of these are things that you would want to see fall through the cracks.

Successful trustees are the ones who are sitting down with a financial planner, evaluating the funds available to the trust, talking to the child or having conversations with the important people in the child’s life to get a sense of what the trust will need to pay for and how long it should last, and making a plan to stretch those funds to meet the needs of the child for as long as possible.

If you don’t have someone you know who can handle that task, you may want to look into selecting a corporate trustee. Note that a corporate trustee is usually a business entity or wing of a bank or other financial institution that offers trustee services. You can ask your estate planning attorney for a recommendation with regard to selecting a corporate trustee, if appropriate to your situation, or you can research corporate trustees on your own. You should know that corporate trustees charge fees, and the fees may vary depending on the value of the trust — in other words, if the value of the trust is modest, then it may not be worthwhile pursuing a corporate trustee as the value could be eaten up by the trustee fees.

How will you fund your special needs trust?

You might be reading this article and saying to yourself, “Hmm, do I really need a special needs trust to protect the tens and tens of dollars I’ll leave behind for my child?”

Having a child with complex medical needs in the U.S. is (ahem) expensive. I yell out on occasion to my kids, “CAN YOU PLEASE BE CAREFUL WITH YOUR BROTHER’S $60,000 BACK?” And I sometimes casually introduce my son as “the most priceless member of our family, and the main reason none of us will get to retire or go to college...”

If that’s you, and if you’re relatively healthy and have no history of a condition that might make you uninsurable, then I’ll tell you to do what I did for my family and what a lot of other parents have done for their families: purchase some term life insurance. It can be relatively inexpensive to purchase the amount of death benefit that you estimate you would need to cover the cost of medical needs and living arrangements for your child or to at least supplement the government benefits that are covering the cost.

For parents of younger children who may not have the majority of their wealth in retirement plan accounts, term life insurance can be a great way to make sure there will be plenty of funds available to direct to a special needs trust. The overarching principle here is that as you continue working and contributing to your retirement plan account, eventually you’ll terminate the life insurance and rely on your retirement plan account to fund the trust.

A few things I wouldn’t do in buying life insurance:

- I wouldn’t use a broker who is employed by one life insurance company and works on commission. Because…I wasn’t born yesterday.

- I wouldn’t purchase more life insurance than I estimate I will need.

- I wouldn’t purchase any fancy combo products (like life insurance combined with disability insurance or converting to whole life insurance) that I don’t understand. What I need is simple: an agreement with a company that they’ll pay a certain amount of money to my kid’s trust if I die unexpectedly.

Buying life insurance is the placing of a bet with the company. You’re betting that you’re going to die before the policy runs out. The life insurance company is betting that you’re not going to die by then. If you win the bet, then the trust gets funded with an amount of money that is astronomically more than whatever you’ve paid in premiums to the company. If the company wins the bet, then you’ve paid some premiums basically for peace of mind — you know that if you pass away unexpectedly, the policy will be the source of funding for the special needs trust.

What about living arrangements for your child?

Definitely talk with your estate planner about the possibility and advisability of including some provisions in your estate plan to deal with your child’s living arrangements. Many people, including some estate planners, have no idea how important the house is in the estate plan of a parent of a child with disabilities. What you don’t want at the end of setting up your estate plan is a nice, professional-looking document that doesn’t address the problem of where your child will live after you die.

Your house is close to your child’s doctors and therapists. It may have been adapted and renovated for a child with limited mobility and/or durable medical equipment. It may be located in a county from which your child is receiving government benefits. The process of establishing an IEP in that county may be very specific and unique. In other words, if it is possible to preserve the house for your child, and if it makes sense in your plan, definitely discuss this with the attorney who is preparing your documents. In my own estate plan, a separate trust exists just for the people who would serve as my son’s guardians so that they can live in my house without worrying about the monthly costs of the house.

If your home is not important to preserve for your child, but you know that your child will need some type of living arrangement to be planned in advance, explore those options now and make sure that the person who is appointed in your plan to serve as your child’s guardian is aware of what options will be available. Investigate group homes, talk to the potential future guardian, include your child in the conversation as much as would be appropriate, and make sure there’s a plan to address this aspect of your child’s life after you pass away.

How will you choose a guardian for your child?

One of the most difficult tasks in this whole estate planning business is choosing a guardian. The guardian is the person who has legal authority over the child. This is especially difficult when the child has disabilities because of the sheer amount of responsibility the guardian will assume. One thing I would consider in selecting a guardian is this: who has a vested interest in the well-being of your child? Generally, this is why most people choose a close family member. Kids who have disabilities are some of the most vulnerable human beings on this earth, and if possible, the person who should serve as a guardian is someone who is linked to the child for life. It should be someone who (ideally) lives close by and is willing and able to live with the child.

Now, how do you communicate to this person (or people, if you’ve chosen more than one person to serve together) what they’re in for? You can leave a detailed letter, which contains all of the information on your child’s care — this is certainly an option. You’d want to be sure to update the letter regularly as your child’s care changes over time. The other (and, in my opinion, more effective) option is to involve the future potential guardian in your child’s care now, if possible.

My son has a G-tube, two wheelchairs, oxygen, and leg braces. The couple we’ve selected to serve as guardians is currently receiving a crash course in my son’s daily care routine because 1) in an emergency, I’d rather avoid the deer-in-the-headlights moment of "Oh wow, what do I do now?" and 2) it’s helpful to have others on hand who could step in even in a non-emergency. Once, when my husband was traveling and I did not have a nurse at home, I almost had to rush my daughter to the doctor, but I couldn’t leave my son with a babysitter unfamiliar with how to do G-tube feeds.

Basically, you don’t want the first time that your selected guardian steps in and handles complex medical care to be in the middle of an emergency. I want that person to be confident and for the care aspect to be second nature, if at all possible. This is also a great way to find out if the person you’ve selected is really up for this or if they need to bow out gracefully and let someone else serve.

What about ABLE accounts and pooled trusts?

Some special needs trusts are established by the child and also funded with the child’s own assets. Additionally, it’s now possible to use an ABLE account to allow your child to accrue some savings without the balance in the account interfering with their financial eligibility for government benefits. It’s important to know the specific use of each type so that you understand when and how these options should be used (if at all).

ABLE accounts can allow a child with disabilities to deposit funds into their account without the accruing balance counting toward an asset limit for a government benefits program. This has (finally) made it possible for some children with disabilities to work and deposit their earnings into this account.

A pooled trust is a special needs trust that is operated by a company. The company serves in the role of trustee and carries out the terms of the trust. The pooled trust operates under an already-formed trust agreement, which means you don’t have the ability to make decisions about the terms of the trust. It also may include provisions that indicate what happens to the funds remaining in the trust (if any) after your child passes away. A pooled trust can be a great tool to use if your child unexpectedly receives some funds that would affect their qualification for benefits. The funds could be contributed to a pooled trust since a trust document would not have to be prepared from scratch by an attorney. This may be an efficient and cost-effective solution.

In sum...

Some things in life should not be left to chance, right? Your four-year-old’s school outfit. The schedule for this week. A nail polish bottle in the hands of your kindergartner. The puppy that hasn’t been outside for a few hours. The partner who doesn’t cook heading to the grocery store with your holiday dinner list. “Overnight” shipping before your child’s birthday. Swim diapers. And also the financial security of your child with disabilities.

Special needs trusts are a tool that exists to protect an inheritance your child may receive from you. They are not simple to establish and may not be inexpensive either, but they serve a very specific purpose, which is to take the funds that you’ve set aside for your child’s future and put them into the hands of a trustee to use for your child’s benefit, in accordance with the terms of the trust. Your estate planner should guide you as to the types of special needs trust that are the most appropriate in your estate plan, and you should ensure that you review the plan on an annual (or more frequent) basis to determine if any changes need to be made.

Making sure you understand what’s been recommended to you and the practical steps in implementing it is a critical piece in planning for the well-being of your child.

Join for free

Save your favorite resources and access a custom Roadmap.

Get StartedAuthor