The Basics of Estate Planning for Parents of Children with Disabilities

Estate planning can feel overwhelming. You know it’s important to have a backup plan for what should happen to your family if you aren’t around, but if you already spend all day, every day, tackling the most pressing issues for your children’s care, it’s easy to put off thinking about your estate plan. However, your family’s well-being is too important to leave to chance.

“So many important pieces of your family rest on you — the CEO, CFO, Medical Director, President, and Treasurer of your household,” says Brianna Davidson Jarrett, Maryland Assistant Attorney General and mother of a child with disabilities. “You have put in too much blood, sweat, and tears to have this thing fall apart if, for any reason, you weren’t able to do all the things.”

To get some insight into this vital but understandably daunting topic, we asked Jarrett to give us a rundown of the basics of estate planning. Many parents don’t know where to start or what they need to consider for the future for their child with a disability, so we’re here to cover what you need to know before you meet with an estate planner.

Jarrett says, “The importance of developing an estate plan when you have dependent children, and particularly when you have a child with disabilities, cannot be overstated. Your plan should be one that you feel confident in understanding as well as adapting over time with your growing or changing family.”

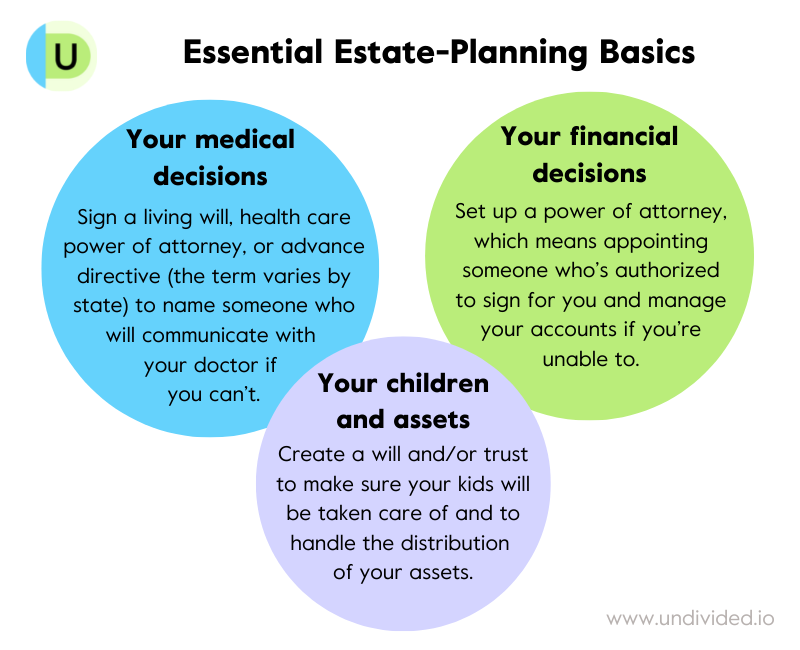

Here are three main areas of estate planning to consider.

Your medical decisions

Jarrett says, “You need a legal document in which you have named a person to make medical decisions on your behalf if you could not communicate with your doctor on your own, and given them instructions regarding the type of care you’d like in an end-of-life situation.”

Depending on your state, this document could be called a living will, a health care power of attorney, an advance medical directive, or a combination of these. It’s possible to fill out and sign this document on your own, but Jarrett recommends working with an estate planner or attorney so that you can customize it to your needs and according to the laws of your state.

Here are Jarrett’s top three tips for preparing your medical directive:

Read the document. “Generally, the preparer is using a form that’s been adapted to your situation. Make sure it reflects your wishes — if you don’t see your instructions in the document, ask the preparer to show you where the document indicates the specific things you decided on; chances are, if you do not see the language, it’s not in the document and should be revised before you sign.”

Give a complete copy to your doctor. “Make sure you know whether a copy is acceptable or if your doctor will need to see an original. The last thing you want is for a stranger to have to go rooting through your glove compartment looking for this thing in an emergency.”

Talk to the person who is going to be making your medical decisions. “Make sure that this person is aware of how you feel about end-of-life care and is familiar with your preferences. I know that this is a conversation that is unpleasant and depressing, but the point of this is to make things easier on your healthcare decision-maker and ensure that the care you would want is what is provided and your wishes are honored as much as possible. This takes the pressure off of your loved one/decision-maker in a big way — rather than trying to figure out what you would have wanted, their job is to instead communicate to your caregivers the decisions you’ve already put in writing and discussed with them.”

Your financial decisions

Jarrett says, “A power of attorney is a document in which you appoint an agent to handle legal and financial matters for you while you are still living. Importantly, a power of attorney has no legal effect after you die. You may hear it referred to as a general power of attorney, durable power of attorney, financial power of attorney, or general durable financial power of attorney — all of these terms refer to the same type of document.”

When might a power of attorney be used? For example, if you became ill or were out of the country and needed to pay a bill, sign a legal document, manage an autopay, or otherwise manage your finances.

Jarrett points out that signing a power of attorney is important for spouses — you can’t sign for each other on everything just because you’re married. You can access any accounts that you hold together, like a joint checking account, but you cannot legally access your spouse’s IRA or other individually held asset without a document authorizing you to.

“Even if you don’t own many assets, and no matter the size of your estate, a power of attorney will allow you to select someone who would have legal authority to step into your shoes and sign your name for you,” Jarrett says. “When you have other people depending on you, and who would be in real trouble in the event that something happens to you, this is usually a relatively simple way to ensure things won’t completely fall apart without you.”

She recommends these three action items when signing this document:

Select a backup agent. “If you have only one agent named, such as your spouse or someone else close to you, and something unexpected happens to both of you at the same time, there is no one to fill this role for you. A simple solution is to name a backup or successor agent in case your first choice, for any reason, can’t serve.”

Ask when the document is effective. “The document can be made effective immediately, or you could indicate that the document should not be effective unless you are proven not capable of handling these things on your own. I’ve seen a lot of situations in which having the document legally effective immediately has been critically helpful, but there are also reasons why you may wish to delay effectiveness until some point in the future. In any event, you should talk through these options with your estate planner and make sure the agent named knows what (if anything) needs to be proven before they can step in for you.”

Give a copy to your bank. “Most large banks will review a power of attorney in advance of it being used and will then keep a copy on file. This is a great way to make sure that in an emergency, if your agent needs to handle your finances, the bank is already aware who your agent is and they’ve already reviewed the document.”

Distributing your assets after you pass away

This is the part of estate planning that most people are familiar with: arranging for who gets your belongings after you pass away.

Jarret has some simple questions to help you start thinking about these decisions:

If your spouse/partner survives you, will everything be distributed to that person?

If your spouse/partner does not survive you, how will your assets be distributed among your children? Equal shares? Different percentages for each?

If you have young children, would you want to prevent them from inheriting from you at an early age by setting up a trust? For a child with a disability of any age, a special needs trust can prevent an inheritance from disqualifying them from their public benefits. If you do establish a trust, who would you want to serve as the trustee in charge of managing those finances?

In the event that you pass away and your spouse/partner is not living, who would serve as the legal “guardian” (term may vary by state) for minor children or a disabled adult child who needs a guardian? What would you choose for the living arrangements for your children?

Who would be the person to handle the paperwork involved in administering your estate after you die?

Jarrett has three tips for making sure the distribution of your assets would go smoothly:

Make sure that your beneficiary designations and titling of your accounts work with your documents. “I know some people who have named a trusted family member as the beneficiary of a life insurance policy with the understanding that this family member will hold the money for their younger children in the event of an untimely death. Example: ‘Oh, I don’t need a trust for my kids. I put my brother Chad on my life insurance, and he’s going to make sure the money is there for them if I die.’ This is so dangerous. (First of all, it’s not if you die, because you are for sure going to die. This is a thing that will happen to all of us.) That family member might predecease you, or may be unwell at the time you die. Also, they might just simply not use the money in the way that you intended, and there is no way for your children to hold that person responsible. The safest way to ensure that your wishes are followed is to let your legal documents do the job they were drafted to do — review your beneficiary designations with your estate planner, and preferably your financial planner, and make sure everything works together.”

Revisit your documents once a year. “The last thing you want is to remember right before you go in for major surgery that your will indicates a once-close friend would be your kids’ guardian if you pass away, but you and that person had a falling out and you are no longer on speaking terms. Take a look at your document once a year, or sooner if you’ve had any major life events, and make sure no changes are needed. If they are, make an appointment with your estate planner to discuss the changes.”

Find out whether a trust, a will, or some combination of both is the best way to distribute your estate. “A trust or several trusts may be the best way to distribute your estate for lots of different reasons — maybe the probate process in your home state is expensive and time-consuming and best to be avoided if at all possible. Don’t assume that a trust is the best option for you instead of a last will and testament — it may be possible to use a simple will that springs into effectiveness only until after you pass away and only if your spouse has predeceased you. Check with your estate planner and make sure you understand, fully, why you are using the document that has been recommended to you.”

Guardianship of children under age 18

Think carefully about who among your family and friends you trust and why, and what traits you appreciate in them that might make them the best guardian for your child(ren) if you were to unexpectedly pass away.

As with your medical and financial decisions, communicate with your chosen guardian ahead of time so that they aren’t blindsided if they ever need to assume their responsibilities.

Jarrett advises, “The person who should serve as a guardian is someone who is linked to the child for life. It should be someone who (ideally) lives close by and is willing and able to live with the child.” If the person you want to serve as a guardian lives in another state or even overseas, it’s a good idea to name a local first responder until the permanent guardian is in place.

Special considerations for children with disabilities

As we mentioned above, if you simply wrote a will leaving assets to your child with a disability, it’s possible that their inheritance would disqualify them from public benefits such as Medicaid or SSI, whether they inherit as a minor or as an adult. Setting up a special needs trust can help you not only protect their inheritance but also set up a structured way to care for their needs long into the future. An ABLE account is a similar tool to provide for your child’s needs without endangering their public benefits, and it doesn’t cost as much as a special needs trust to set up but does come with some limitations to how much money can be in the account. You can set up either or both depending on the size of assets you want to leave your child. Learn more in our article all about ABLE accounts and special needs trusts.

Letter of intent/plan of care

A common aspect of a special needs trust is a letter of intent, also known as a plan of care, that tells the trustee how the funds in the trust are supposed to be used to care for your child. This informal document can also include many details about your child’s support needs, preferences, and strengths so that whoever is responsible for taking care of your child has instructions. Even if you don’t create a special needs trust, a plan of care is a useful document to include in your estate plan. You can learn more about creating a letter of intent in our article here.

Conservatorship/guardianship

Another issue to consider in your estate plan is guardianship (called conservatorship in California) for a child with a disability over age 18. If you have authority granted by your state to make legal, medical, financial, or other decisions for your adult child, then you need to name a successor conservator who will assume this role when you pass away or become incapacitated, or else the state will make this decision for you. Involve your child in this discussion as developmentally appropriate. If you did not name a backup when you originally set up the conservatorship, you will likely need to petition the court to appoint a contingent or successor conservator/guardian.

Supported decision-making

If you choose an alternative to conservatorship, such as supported decision-making, to help your adult child manage decisions, this is still an important topic to discuss in your estate planning. For example, if you have a power of attorney document signed by your child authorizing you to help manage their finances or medical care, that document can designate a backup agent so that they still have support when you are not available.

Choosing an estate planner

If you’re embarking on this journey for the first time, we recommend asking other parents in your community about who they’ve turned to for estate planning help. Nothing is better than first-person testimonials. Undivided members in California can access lists of attorneys vetted by our Research Team to work with families raising kids with disabilities. FindLaw and Justia Lawyers have directories where you can find estate lawyers in your state or even city.

In your search, make sure the attorney you choose to work with has experience helping prepare estate plans for parents of kids with disabilities. Hear Jarrett explain why:

As you’re reaching out to potential estate planners, here are some questions to help you narrow down your options and choose a good fit:

- What is their background? Do they have experience with family situations like yours?

- What is their payment structure? Is there a flat rate or hourly charge for services?

- Do they prefer to email with clients, talk on the phone, meet online, or meet in person? Which forms of communication will you be charged for?

- Do they have a waitlist? When can they begin working with you?

- What is their goal in helping clients? Do you feel like your priorities and strategies align?

Getting started

Plan for my child's financial future

Jarrett says, “If this feels complicated, that’s because it is complicated. Establishing a backup plan to make sure the right tools are in place is not an easy thing to do — because your life IS complicated. When you are the person others are depending on, however, you owe it to these people to make sure they remain cared for in the best way possible if you weren’t here to do it. For those of us who have children with complex needs, we know (likely better than most) that human life is so fragile and unpredictable. Do this for the people in your life who are counting on you. Do it for yourself. No matter what drives you — take this information and get it done.”

Here’s some final encouragement: you can do this!

Join for free

Save your favorite resources and access a custom Roadmap.

Get StartedAuthor